Personal Tax Estimator

With this tool you will be able to estimate the total cost for having our firm prepare your personal tax return

Thanks, we will contact you soon

Step 12

Do you own rental property?

Yes

No

How many?

How many?

You may need a Sch E!

Disclaimer

This tool is for estimating purposes only.

It is designed to accommodate most but not all situations. You may have circumstances that

require forms that are not covered in this estimator and may increase the cost of the tax return.

If the information you provide to prepare this estimate does not match the information you bring

to prepare the tax return, the cost of the tax return may go UP OR DOWN based on the actual

information provided.

What was your income?

My income was in the rang of

Dependents

How many under the age of 12?

How many under the age of 16?

You MAY qualify for Earned

Income Credit

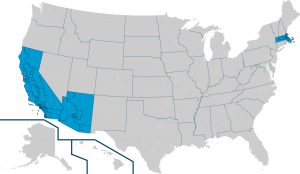

Step 2.1

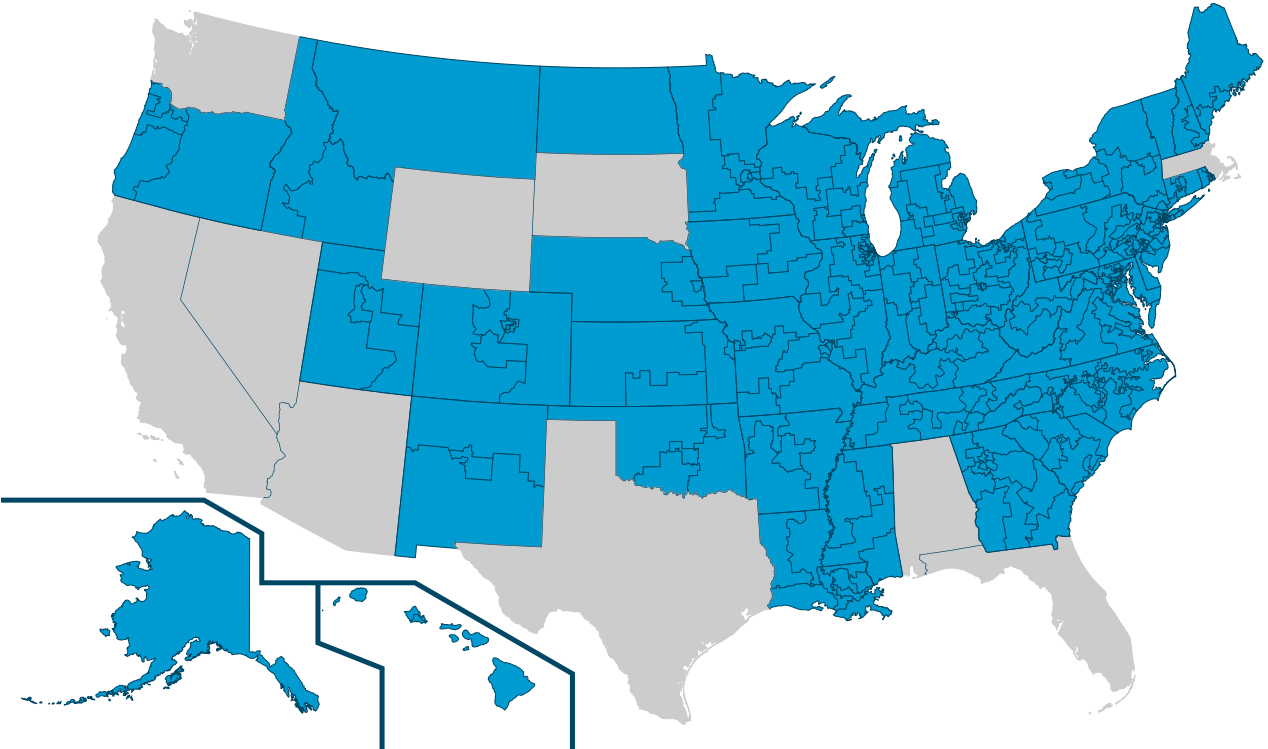

Select the group with the other state you lived in

Step 4

Did you work a W2 job?

Yes

No

How many W-2’s did you receive?

How many W-2’s did you receive?

Step 3.2

Did your spouse work a W2 job?

Yes

No

How many W-2’s did your spouse receive?

How many additional states did your spouse receive W-2’s in?

How many W-2’s did your spouse receive?

Step 3.1

Will you file with your spouse?

Yes

No

Step 14

Do you have dependents?

Yes

You MAY qualify for Earned

Income Credit

No

Step 13

Do you own your own business that you claim on your PERSONAL return?

Yes

No

How many?

How many?

You may need a Sch C!

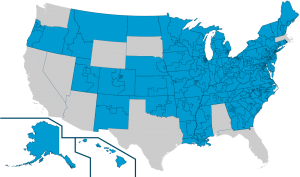

Step 1

Select the state group you live in

CA, MA or AZ

AL, FL, TX, NV, SD, WA, WY

All others

Step 11

Do you receive K-1’s from Partnerships, Trusts or S Corporations?

Yes

No

How many?

How many?

Step 10

Did you sell stocks last year?

Step 9

Did anyone on the tax return go to college and will receive a 1098-T?

Yes

No

How many?

You MAY qualify for

Education Credit or a Tuition Deduction!

How many?

Step 8

Do you own or rent your home?

Own

Rent

You may need a Sch A!

Step 7

Did you have interest or dividends over $1,500

Yes

No

Step 6

Did you receive retirement income last year?

Yes

No

How many sources did you receive retirement income from?

How many sources did you receive retirement income from?

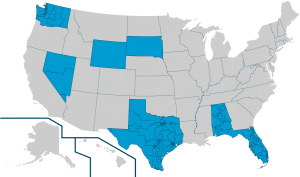

Step 5

Did you work in any additional states?

Yes

No

How many states did you work in?

How many states did you work in?

Step 3

Are you married?

Yes

No

Step 2

Did you live in any other states for the tax year?

Yes

No

Final cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||