How to Read a Balance Sheet

UncategorizedThe first thing to remember about a balance sheet is that it is a snapshot of a company financial condition a specific point in time. A balance sheet is usually comprised of three sections (assets, liabilities and owners equity). So firs...

Are Office Parties Deductible?

UncategorizedThe first requirment for the party to be fully deductible is it must be for employees. All employee must be allowed to attend. A party for a special class of employees will likely run afoul of this requirement. The party must be only for...

Tax Tips for Newlyweds

UncategorizedLate spring and early summer are popular times for weddings. Whatever the season, a change in your marital status can affect your taxes. Here are several tips from the IRS for newlyweds. It’s important that the names and Social Sec...

Shareholder Loans Must be Properly Documented

UncategorizedLoans from corporations to shareholders are the subject of an IRS Audit Technique Guide that stresses the possibility of treating them as distributions and therefore taxable as dividends. The IRS also continues to vigorously litigate the...

Prepare for Disasters by Safeguarding Tax Records

UncategorizedCreate a Backup Set of Records Electronically Taxpayers should keep a set of backup records in a safe place. The backup should be stored away from the original set. Keeping a backup set of records –– including, for example, bank sta...

Family Caregivers and Self-Employment Tax

UncategorizedSpecial rules apply to workers who perform in-home services for elderly or disabled individuals (caregivers). Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elde...

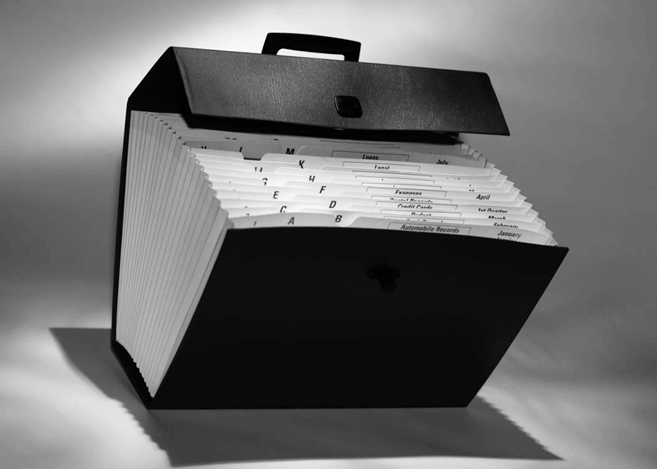

Keeping Records for Itemized Deductions

UncategorizedKeeping the proper records so you can determine and substantiate the amount of various deductions is a task that does not need to be daunting. Here are some tips on what is needed. For all deductions remember just keeping a bill is not e...

Building Your Contact Database

UncategorizedAll businesses regardless of size share a common and critical pursuit – to continually attract new clients. There’s one resource whose value you should never underestimate for generating and maintaining a steady influx of new clients: ...

Essential Estate and Gift Tax Facts

UncategorizedA federal tax is imposed on the value of estates that exceed a statutory exclusion. That threshold of untaxed value is $5,340,000 in 2014. Estates worth more than that amount are taxed at a 40 percent rate. This means that a married coup...

A One-page Guide to the Health Insurance Marketplace

UncategorizedImportant. Marketplace Open Enrollment ended March 31. You can still buy a Marketplace health plan only if you qualify for a special enrollment period. You can apply for Medicaid and CHIP any time. Find out if you qualify for a S...